Have you ever wondered what it would take to secure a million dollars in life insurance? It’s a question that crosses many of our minds at some point, whether it’s to protect our loved ones financially or to ensure our own legacy. The cost of a million-dollar policy can vary significantly depending on factors such as age, health, and lifestyle, but one thing is for sure: it’s an investment that can provide invaluable peace of mind.

- Deciphering the Cost Spectrum of Million-Dollar Life Insurance

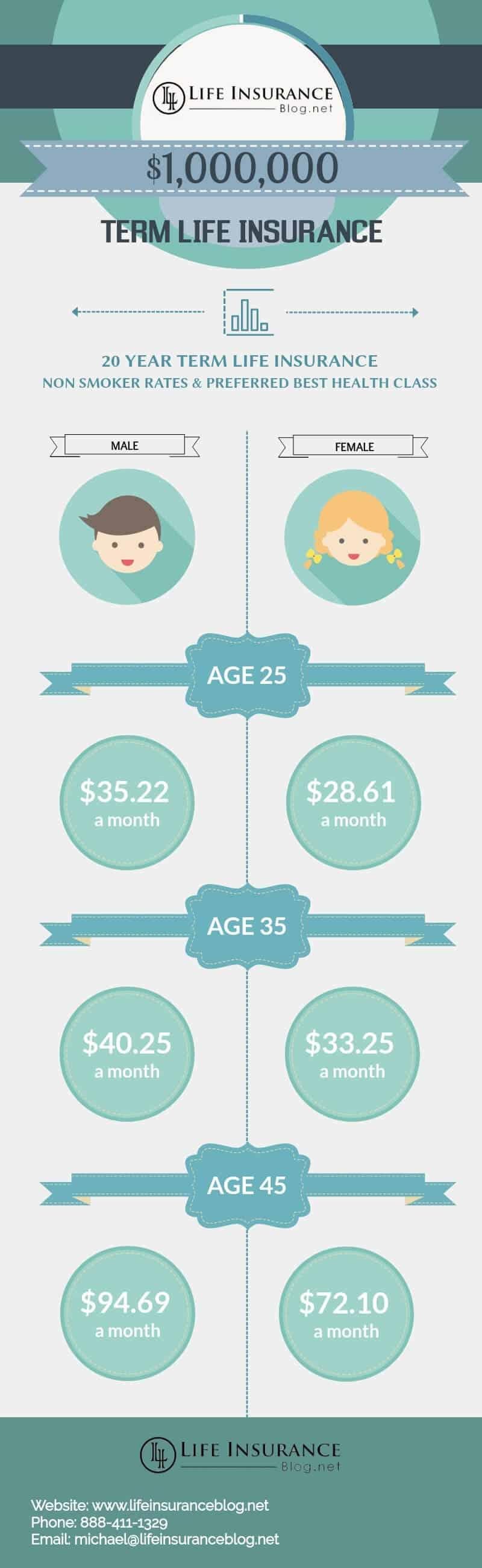

While the exact cost of a million-dollar life insurance policy varies depending on your individual circumstances, there are some general factors that can impact the premiums. These include your age, health, lifestyle, and the type of policy you choose. Generally speaking, younger and healthier individuals will pay lower premiums than older or less healthy individuals. Additionally, certain risky behaviors, such as smoking or skydiving, can increase your premiums. The type of policy you choose will also affect the cost. Term life insurance is typically less expensive than whole life insurance, since it only provides coverage for a specific period of time. Whole life insurance, on the other hand, provides coverage for your entire life and also has a cash value component that can grow over time.

The following table provides a general overview of the average cost of a million-dollar life insurance policy for different age groups and health statuses:

| Age Group | Average Annual Premium for a Healthy Individual |

|—|—|

| 20-29 | $300-$500 |

| 30-39 | $500-$700 |

| 40-49 | $700-$900 |

| 50-59 | $900-$1,200 |

| 60-69 | $1,200-$1,500 |

– Unveiling the Factors Influencing Premium Rates

Factors Impacting Premium Rates

The cost of a million-dollar life insurance policy is not a fixed number but rather a complex calculation based on several key factors that determine the risk profile of the insured individual. These include:

Age: As individuals age, the likelihood of health issues and mortality increases, leading to higher premium rates.

Health: Preexisting conditions or ongoing treatments can impact the insured’s life expectancy, influencing premium costs.

Tobacco Use: Smokers or former smokers typically face elevated rates due to the increased health risks associated with tobacco use.

Lifestyle Factors: Activities like skydiving or hazardous sports can raise premiums as they increase the likelihood of accidents or mishaps.

Occupation: Individuals working in hazardous occupations, such as firefighters or construction workers, may have higher premiums due to the potential for workplace incidents.

Gender: Historically, men have had shorter life expectancies than women, resulting in slightly higher average premiums for male insureds.

* Family Health History: A history of serious diseases or genetic predispositions within the family can influence premium rates.

– Crafting a Personalized Million-Dollar Life Insurance Strategy

Understanding Life Insurance Costs

The cost of a $1 million life insurance policy depends on your health, age, and personal preferences. Your overall health and lifestyle determine your life expectancy, and higher life expectancy typically means higher premiums. Age also plays a role, as younger individuals tend to have lower premiums due to their longer life expectancy. Other factors such as hazardous activities, smoking habits, and occupation can also influence your premiums.

It’s important to consider your future life insurance needs when choosing a policy. The cost of the policy will likely remain constant, but your circumstances may change. Think about potential future expenses such as education expenses for your children or providing financial support for your spouse. Understanding your unique needs will help you find a personalized policy that aligns with both your budget and your overall financial goals.

Sample Life Insurance Premiums

The table below provides estimates of annual premiums for a $1 million life insurance policy based on different age groups and genders. These estimates are for illustrative purposes only and should not be relied upon for final premium calculations. To receive an accurate quote for your specific situation, it’s recommended to consult with a licensed insurance agent or use online comparison tools.

| Age Group | Gender | Annual Premium Estimate |

|—|—|—|

| 20-29 | Male | $450-$850 |

| 20-29 | Female | $350-$700 |

| 30-39 | Male | $550-$1,000 |

| 30-39 | Female | $450-$850 |

| 40-49 | Male | $750-$1,300 |

| 40-49 | Female | $650-$1,150 |

| 50-59 | Male | $1,100-$2,200 |

| 50-59 | Female | $900-$1,900 |

| 60-69 | Male | $1,700-$3,500 |

| 60-69 | Female | $1,500-$3,000 |

Wrapping Up

Unveiling the enigma that is the cost of a million-dollar life insurance policy is a journey that has reached its end. Like a ship navigating uncharted waters, we have explored the factors that influence this monetary labyrinth, from age and health to lifestyle and occupation. The sum you pay may not be as static as a North Star, but instead a dynamic entity that ebbs and flows with the symphony of your life’s narrative.

Remember, the true value of life insurance lies not in its price tag, but in the peace of mind it bestows upon your loved ones. It’s a testament to your foresight, a beacon of financial security in the face of life’s uncertain storms. As you ponder the cost, consider the immeasurable weight of protection and provision it offers. The premium you pay is not merely an expense; it is an investment in the well-being of those who matter most.