Title: Which Debts Should You Pay Off First: Credit Cards or Student Loans?

Introduction:

Are you navigating the labyrinth of financial obligations, entangled in the web of credit card and student loan debt? The question that looms large is: which of these adversaries should you conquer first? In this article, we embark on an investigative journey to reveal the optimal strategy for vanquishing these financial foes. Join us as we weigh the pros and cons of each debt, delve into repayment strategies, and ultimately empower you with the wisdom to make an informed decision, forging a path towards financial freedom.

Impact on Your Financial Situation: Analyzing the Long-Term Implications of Prioritizing One Debt Over the Other

Impact on Your Financial Situation

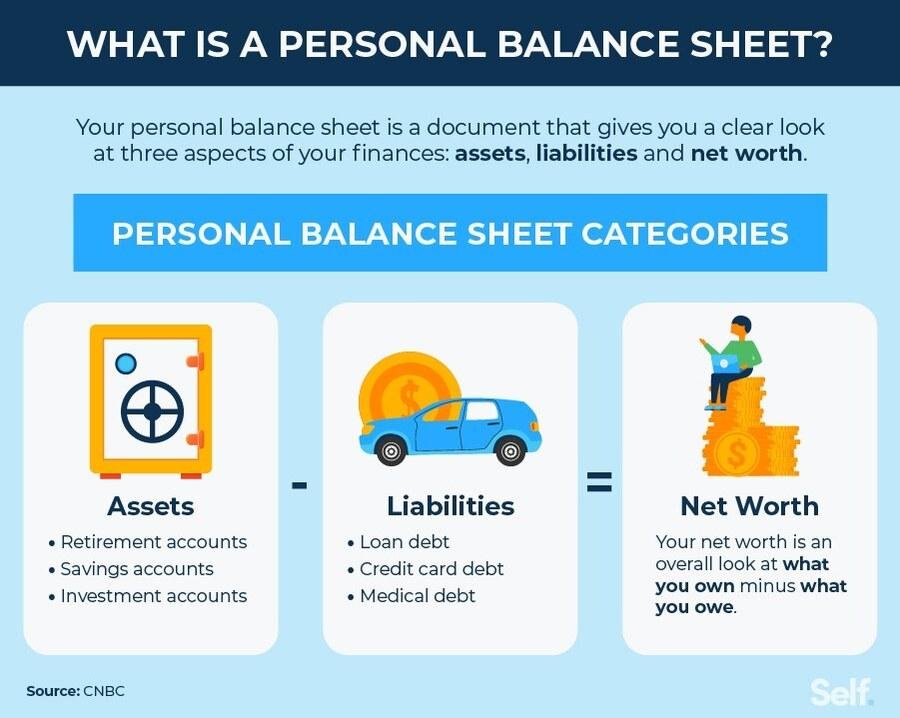

Prioritizing one debt over the other can have a significant impact on your financial trajectory. Repaying high-interest debts like credit cards first allows you to save money on interest charges and improve your credit score faster. However, it could delay your student loan payments, which typically have lower interest rates but may carry long-term consequences if left unpaid.

Conversely, focusing on student loans can free up your budget for other expenses, like saving for a down payment on a house. However, carrying high credit card debt can damage your credit, making it difficult to qualify for loans or favorable interest rates in the future. Ultimately, the choice depends on your individual circumstances and the potential impact it will have on your overall financial situation.

Interest Rates and Fees: Uncovering the Hidden Costs Associated with Each Type of Debt

Interest rates and fees: hidden costs that can add up:

Just as with APR, cardholders may be subject to various fees, such as:

- Annual fees

- Balance transfer fees

- Cash advance fees

- Late payment fees

In some cases, these fees can be significant and can add up quickly, especially if you carry a high balance or make frequent cash advances and balance transfers.

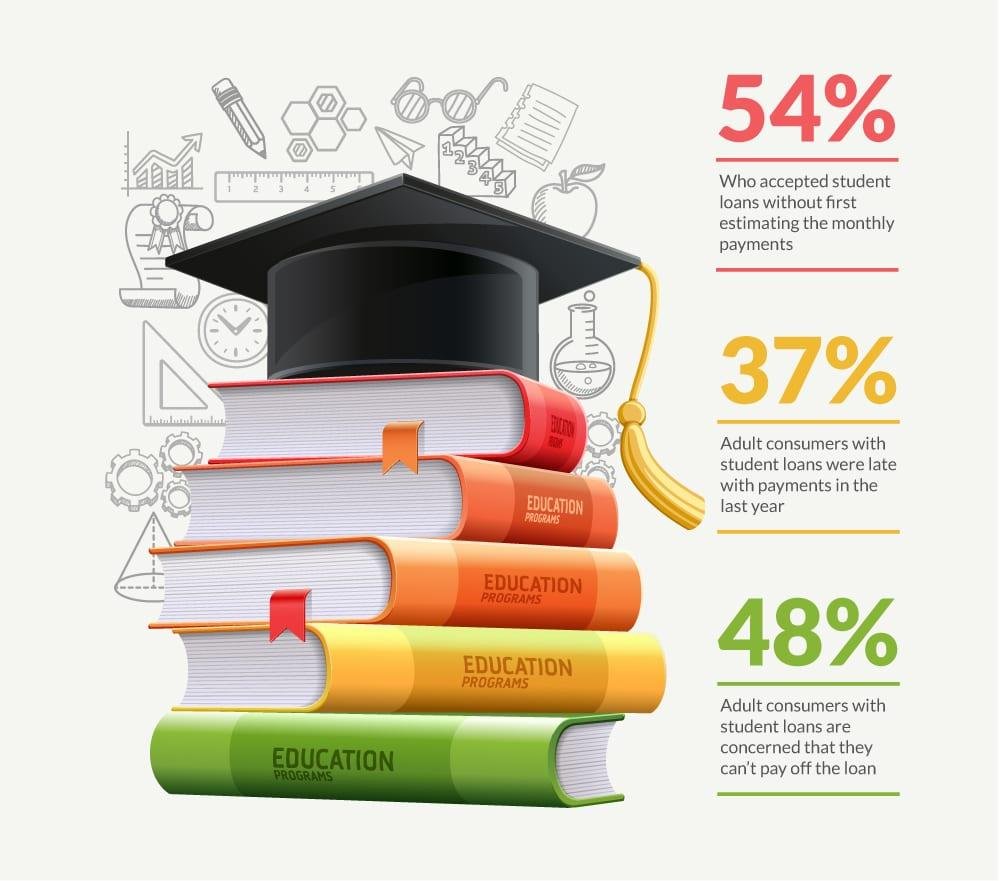

With student loans, interest rates and fees can vary depending on the type of loan and your creditworthiness. Federal student loans typically have lower interest rates than private loans, but they may also have origination fees and other charges. One major difference is that federal student loans usually come with income-driven repayment plans, which can help make payments more manageable if you have limited funds.

Strategic Considerations: Balancing Short-Term Relief with Long-Term Goals

Balancing Short-Term Relief with Long-Term Goals

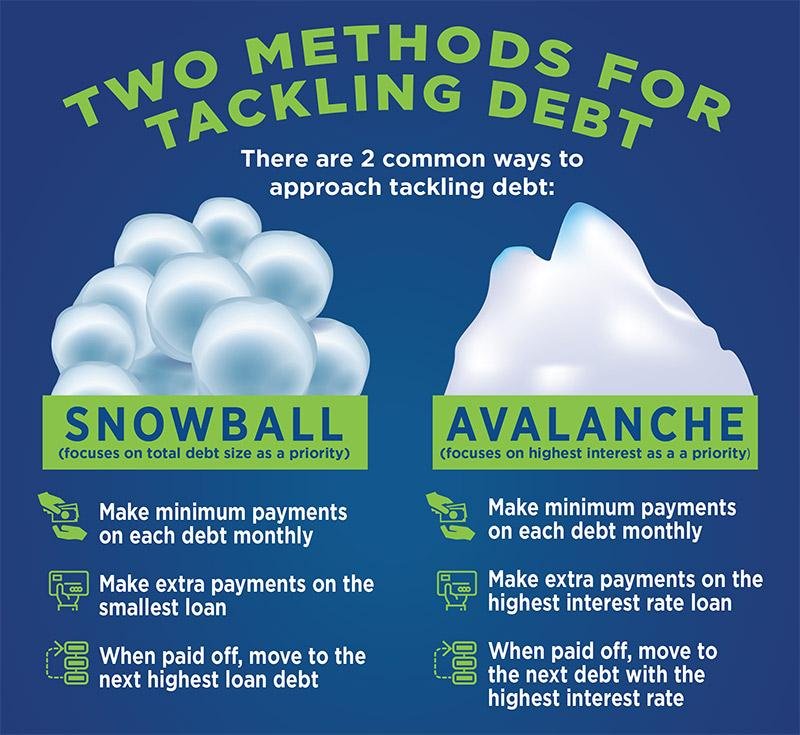

When prioritizing debts to pay off, consider both the immediate financial stress you’re experiencing and your long-term financial health. While paying off credit card debts may provide short-term relief from high interest rates, prioritizing student loan payments can have a positive impact on your future earning potential. Additionally, federal student loans often offer income-driven repayment plans that can make payments more manageable while still contributing to debt reduction.

Consider the following factors when balancing short-term relief with long-term goals:

Interest rate: Credit cards typically have higher interest rates than student loans, so paying them off first can save you money in interest payments.

Credit score: Paying off credit card debt can improve your credit score, which can qualify you for better terms on loans and other forms of credit in the future.

* Long-term income: Student loans can help finance education that leads to higher income-earning potential. Prioritizing student loan payments ensures you invest in your future earning power.

Key Takeaways

As you embark on your debt repayment journey, remember that the path you choose is uniquely yours. Whether you tackle credit cards or student loans first, prioritize a strategy that aligns with your financial goals and circumstances. Embrace the empowered feeling that comes with taking control of your financial future, and let the road ahead be one filled with financial freedom.